Banks Scam millions of students |

|

|

|

| Written by RC Christian |

| Friday, 01 June 2012 11:45 |

| More than 9 million students are at risk for increased educational debt, due to bank-affiliated campus debit cards that come with high fees, insufficient consumer protections, and few options, reported U.S. PIRG, the federation of state Public Interest Research Groups.

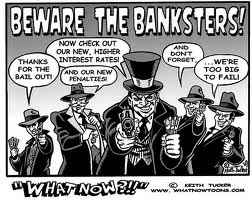

Banks and other financial organizations have established partnership agreements with 900 campuses nationwide, selling bank products onto student IDs and other campus cards with the goal to become the primary recipient of billions in federal financial aid to distribute to students.“Campus debit cards are wolves in sheep’s clothing,” observed Rich Williams, U.S. PIRG Higher Education Advocate and report co-author. “Students think they can access their dollars freely, but instead their aid is being eaten up in fees.”The Campus Debit Card Trap, a new report released by the U.S. PIRG, discovered that banks and financial institutions control and influence federal financial aid disbursement to over 9 million students by linking checking accounts and prepaid debit cards to student IDs. For years, students would receive their financial aid by check, without being charged any fees to access their student reimbursement money. Now, students end up paying big fees on their student aid, including per-swipe fees of $0.50, inactivity fees of $10 or more after 6 months, overdraft fees of up to $38 and plenty more, continued the consumer protection group PIRG. Campus Debit Card ScamThe report found that millions of students are affected. Higher One, the biggest financial firm, has partnerships with 520 colleges that enroll 4.3 million students, according to the report. Wells Fargo, the biggest bank in the market, partners with 43 campuses that enroll over 2 million students. According to U.S. PIRG Education Fund research, there is big money at stake. Higher One makes 80% of its revenues by siphoning fees from student aid disbursement cards, totaling $142.5 million of its $176.3 million total revenues in 2011, according to SEC filings. These fees include ATM and other transaction fees, overdraft fees, and interchange fees imposed on merchants who accept cards. Concerns increase as these ‘financial’ service appears to be endorsed by the colleges. In the report was noted that Huntington Bank paid $25 million to co-brand and link their checking accounts with Ohio State University student IDs. Other schools receive substantial payouts, revenue sharing deals, and large reductions in administrative costs, says U.S. PIRG.“Many bank contracts require aid recipients to visit the provider’s website before they choose how to receive their aid – into an existing account, on a check or on a disbursement card — again implying an endorsement,” commented Williams. These business arrangements are certainly not to the best interest of young students, as schools may be tempted to choose the agreement that allows them to profit the most instead the contract that gives their students the best deal.“The campus debit card marketplace is tilted so that students can’t get a fair deal,” said Ed Mierzwinski, report co-author and U.S. PIRG Consumer Program Director. “Campus administrations and policymakers have the power to clean it up.” Mierzwinski also urged the Consumer Financial Protection Bureau to upgrade consumer protections on prepaid cards. The report includes a list of recommendations for ways student consumers can avoid these high fees.For a full copy of the report click here: http://uspirgedfund.org/reports/usf/campus-debit-card-trap |